Medium-term Management Plan

Future Outlook and Challenges

■ Future of COVID-19 unclear

― No end in sight.

■ Transformation in life and working styles

― Establishment of remote work and increased time at home.

Challenges

Break away from file-dependent earnings structure

■ Transformation in life and working styles

― Establishment of remote work and increased time at home.

■ Shift toward paperless and digitization

― Decrease in paper, change in personal effects.

― Decrease in paper, change in personal effects.

Break away from file-dependent earnings structure

Our Strengths

■ Flexible product development structure and a wide array of original products

― In addition to stationery, lineups of electronic products and sundry goods.

■ Extensive sales channels

― Multifaceted rollout not dependent on specific channels. Also in possession of e-commerce channels, which are doing well under the COVID-19 pandemic.

■ Business domain expansion and Group management

― Not fixated on the stationery business. Synergistic utilization of Group management resources.

Policies

■ Develop products for new lifestyles and ways of working.

■ Shift from paper storage to stuff storage. Expand sundry and household goods.

■ Further develop the Group through mergers and acquisitions.

2.Enhance the competitiveness of three overseas factories

■ Bring in production technologies for products other than stationery.

■ Expand the variety of production items.

3.Sustainability initiatives

■ Contribute to society through products that make life and business convenient and comfortable.

■ Environmentally conscious procurement, design, and development. Respond to climate change.

■ Promote diversity and realize diverse working styles.

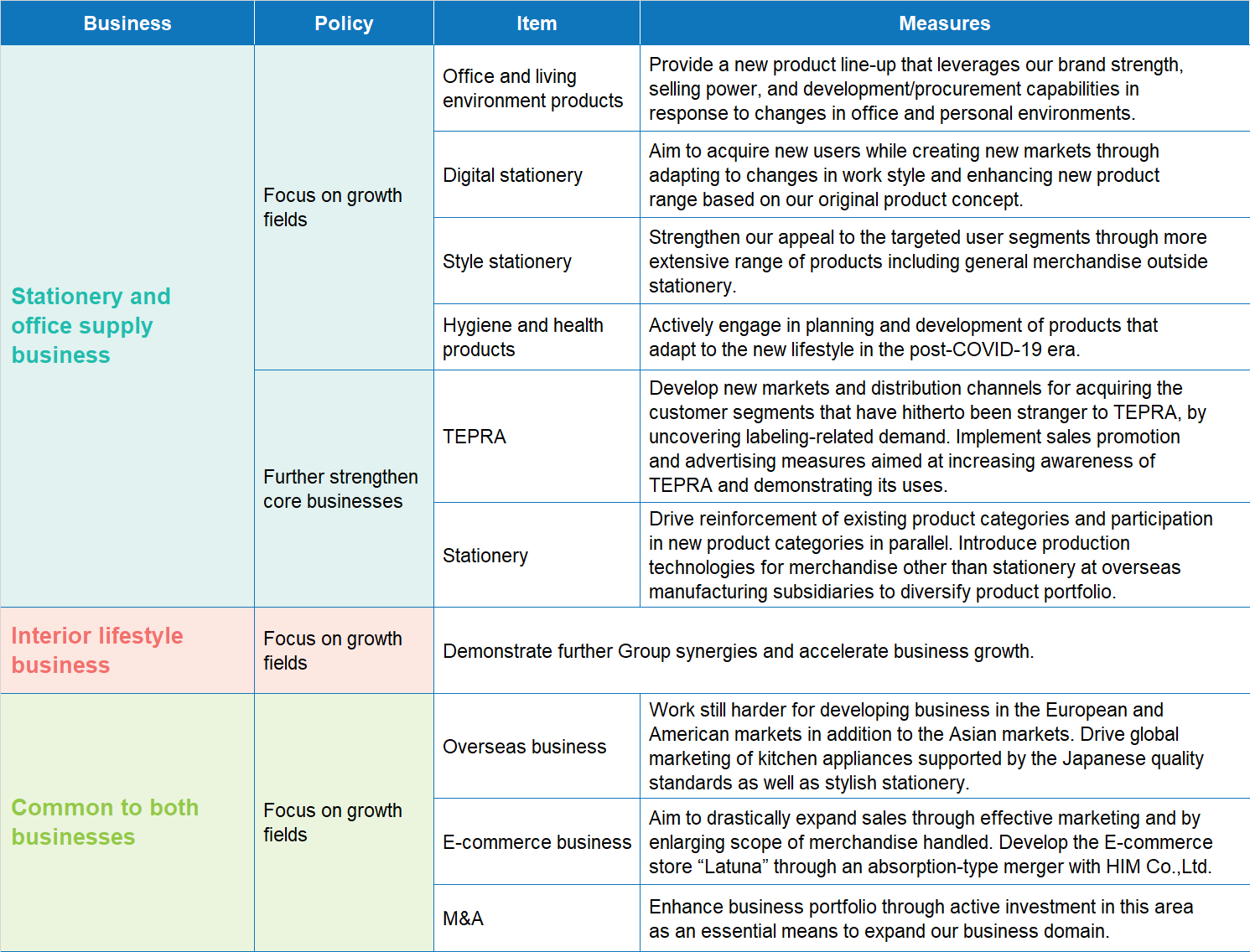

Strategy by Business

Allocation of Management Resources

■ Expand strategic investment in growth fields

― Business domain expansion: ¥10.0 billion

― New product development and production facilities investment: ¥2.0 billion

― Human resources investment concentrated on growth fields such as product development and overseas business

■ Investment to increase efficiency

― Sales and distribution system renovation: ¥1.0 billion

Shareholder returns

■ Payout ratio: 40%

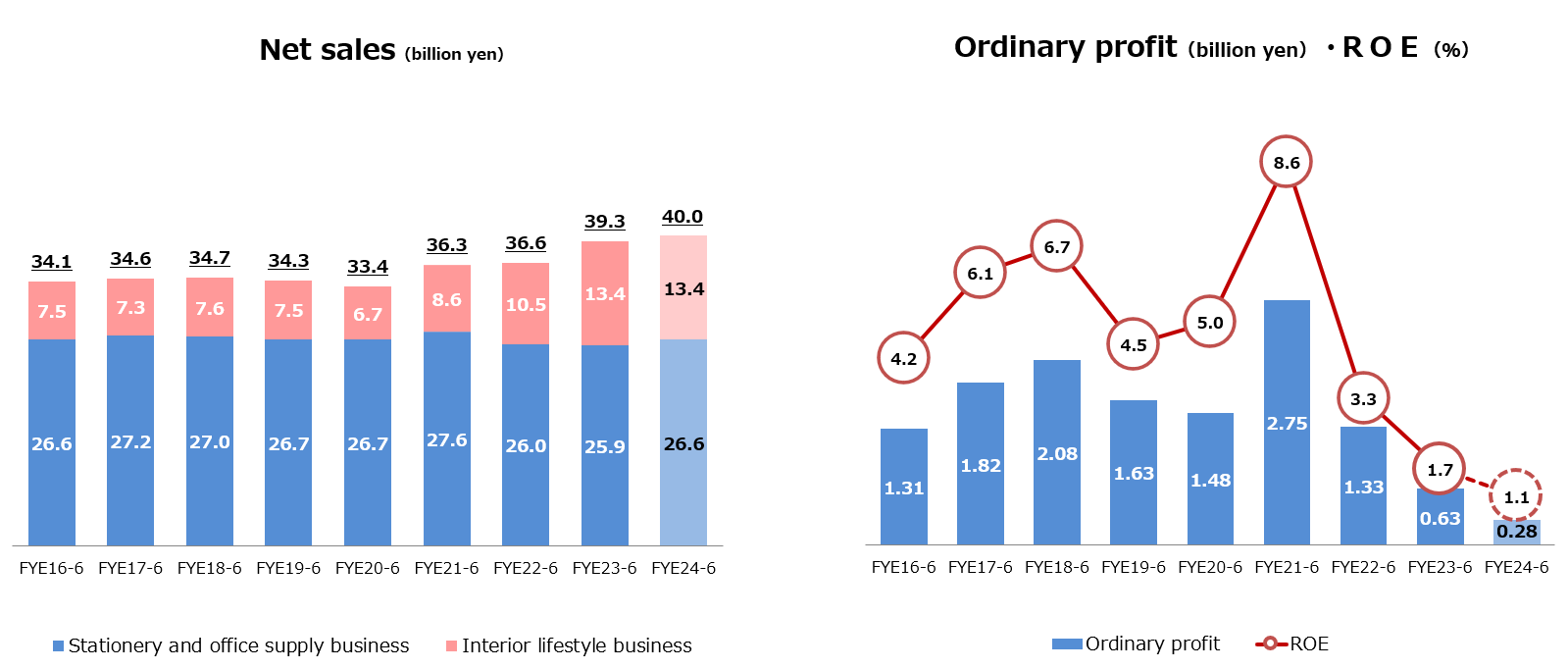

Management Targets

| Net sales |

¥40.0 billion Stationery and office supply business ¥26.6 billion Interior lifestyle business ¥13.4 billion |

| Ordinary profit |

¥0.28 billion |

| Ordinary profit ratio |

0.7% |

| ROE | 1.1% |

Initiative Status

M&A

In November 2021, we acquired all shares of Life on Products, Inc. and made it a subsidiary. Life on Products, Inc. is engaged in the planning and sale of various products, including household appliances, everyday goods, and room fragrances. By adding it to the Group, we aim to realize a dramatic expansion of our interior lifestyle business.

In September 2022, we acquired all shares of HIM Co., Ltd. and made it a subsidiary. HIM Co., Ltd. operates in the planning and online selling of kitchenware and everyday sundries that make modern life more convenient and has continued to grow rapidly since its foundation. We and the Group aim to further strengthen and expand the E-commerce business dramatically by welcoming HIM Co., Ltd. into the Group.(On February 1, 2023, we absorbed and merged with HIM Co., Ltd.)

New product launches(The First Year)

In the growth field of “office and living environment products,” we launched the “Microphone with Speaker,” a loudspeaker that combines a speaker and microphone, so it does not require audio equipment. It has been well received as equipment for schools and public facilities. In “hygiene and health products,” we launched the new CO2 Monitor, which can display the CO2 concentration in a room as a countermeasure against COVID-19 infection. In the “interior lifestyle business,” we achieved strong performance with our mainstay products, such as LADONNA CO., LTD.’s kitchen appliances and ASCA CO., LTD.’s artificial flowers.

To further strengthen our core business, we launched the SR-R980, the new highest-end model of TEPRA.

Priority Measures for the Future

New products

We will continue to develop products that meet the needs of society, while further expanding sales of products such as the alcohol detector Alcohol Checker in “office and living environment products,” and the new DM250 digital memo POMERA in “digital stationery.” In the “interior lifestyle business,” we will also develop new products for the core product lines of each Group company and expand the range of products we handle.

Price revisions

In response to soaring prices of raw materials and other materials, we have endeavored to maintain our prices by reducing costs and improving productivity. However, it has become extremely difficult to maintain the existing prices through our own efforts, so we will revise the prices of some products with the aim of improving profitability.

Group synergy

We will strive to create group synergies, including our new Group company Life on Products, Inc., by improving efficiency through joint product procurement and quality control among Group companies, as well as sales growth through mutual utilization of sales channels both in Japan and overseas.

M&A

As an essential means to expand our business domain, we will enhance our business portfolio by actively considering M&As that can be expected to create group synergy.

- Basic Policy and Structure

- Directors and Auditors

- Addressing the Corporate Governance Code

- Compliance and Risk Management

- Internal Control System

Contact IR